Best Accounting Software for Small Business in 2025

Keeping track of your finances, creating invoices, and calculating your taxes can often be taxing. However, a few key accounting software for small business makes keeping your financial records in order quick and easy.

Choose from our best online accounting software:

- Send & track quotes and invoices

- Keep track of receipts and expenses

- Automatic bank reconciliation

- Payroll (add-on)

- Easy invoicing

- Keep track of expenses & payments

- Double entry accounting

- In-depth reporting

- Create & track invoices, expenses & taxes

- Link bank accounts

- Built-in reporting

- Payroll integrated

Whether it’s creating invoices for your clients, making sure the employee payroll gets paid on time, and making sure the business costs isn’t getting too high, the right accounting tools can help you with that.

They are packed full of features that make your day-to-day running of your business finances easier, letting you get on with marketing and growing your empire, no matter how big or small.

Move away from hard-to-read spreadsheets and invest in an online accounting tool.

Here’s our pick of the best small business accounting software:

1. Freshbooks

FreshBooks is an all-in-one accounting software for freelancers, self-employed, and small business owners with employees or contractors.

They give you the accounting tools you need to take control of your finances and save you time easily.

You’ll be able to create professional-looking invoices, keep track of all your expenses, and keep an eye on all your payments to make sure you’re getting paid on time.

Their handy reporting can create a financial report giving you a quick view of your profit and loss and automatically crunch the numbers for you, so you know how much tax you need to pay when it’s time.

With the FreshBooks mobile app available on Android and iOS, you can see everything you need to while on the go. You’ll be able to create unlimited invoices, take photos of receipts, and even record your mileage as you travel for business.

You’ll also be able to track when your clients have viewed their invoices and when they’ve been paid, letting you chase when you need to.

FreshBooks synchronizes across all devices means you’ll never miss important messages or payments again.

You can try FreshBooks accounting for free with their 30-day free trial with no credit card required, letting you check out the full version with all the features for yourself with no obligation to buy.

If you decide to buy, they often have deals letting you get the first few months at lower prices before it increases a little later, as many cloud accounting software services do.

The only downsides are that there’s not much customization available, and some payment features can only be set up as one-offs rather than recurring payments for Direct Debits. Their customer support could also do with fine-tuning.

Features:

- Invoicing

- Expenses

- Time Tracking

- Projects

- Payments

- Reporting

- Core Accounting

- Mobile App iOS & Android

- Cloud accounting software

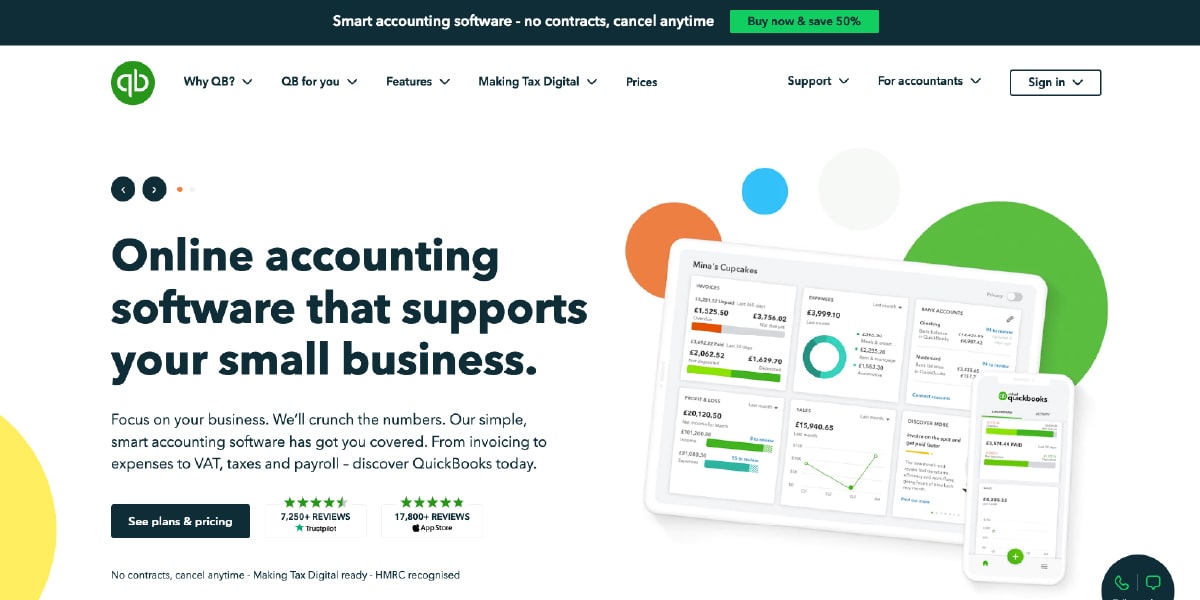

2. Quickbooks

Over 4.5 million businesses around the world use intuit QuickBooks accounting software to save themselves time on doing their accounts each month.

Sign up for a 1 month’s free trial, and you’ll get access to all their features, including your standards like Invoicing, Payroll, Expenses tracking, and VAT software and Tax Software, making sure you are compliant and up to date.

Integrate with their built-in payment services, and you’ll be able to take bank payments, PayPal, and more.

The intuit QuickBooks online cashflow insights let you understand your finances at a glance, displaying reports on your income and expense tracking so you can see where you’re making money and where you’re potentially losing it too.

Depending on what size business you are will determine what features you need. The Quickbooks self-employed plan starts from as little as £8/month with their sole-trader and small business plans starting at just £12/month.

Given all the accounting features you get, those kinds of prices aren’t going to break the bank and will probably save you more money than it costs with the time you save doing your finances.

Like most online accounting software, there are some downsides, like their mobile app isn’t as fully featured as the online access, and their customer service solving issues could be speedier.

Features:

- Invoicing

- Payroll

- Time Tracking

- CIS

- Payments

- Cash flow reporting

- Accounting

3. Sage Accounting

As one of the biggest online accounting software companies, Sage offers a large variant of different applications to help you with varying needs of your business, from HR to Payroll, to the day to day Accounting.

Tailored to sole traders and small businesses, Sage Accounting is easy-to-use cloud-based accounting software that lets you create invoices, control your cash flow and keep digital records of your receipts and expenses.

Price plans vary depending on which option you choose, with packages for freelancers and sole traders given the cheapest option. Small businesses can increase the number of features, including advanced reports and the ability to send unlimited quotes and estimates for a slightly higher price.

Sage Accounting lets you automate many aspects of billing and keeping track of payments, giving you the option to automatically send invoices to your clients, receive payments and make refunds where necessary.

The Sage Accounting mobile app lets you connect to your account on iOS and Android, helping you manage your business finances on the go.

You can start a 30-day free trial of the Sage Business Cloud Accounting; no credit card required. It’s a great way to see if it has all the features you need to run your business efficiently.

Features:

- Accounting & Payroll

- Billing

- Bank Connections

- Reporting

- Invoicing

- Tax & VAT

- Mobile App

- Self-Assessment

4. Wave – Best Free Accounting Software

Wave accounting offer award-winning financial software for small businesses.

An online accounting solution, Wave will keep track of your income and expenses, track sales tax, and connect to your banks. Thanks to their powerful reporting system, you’ll have the ability to create professional-looking invoices and see what your money is doing.

And that’s all for free.

That’s right, unlike the others on this best accounting software list, when it comes to a powerhouse of free financial software, then Wave has you covered. No setup or monthly fees to consider.

What you will have to pay for is credit card processing, if you choose to process payments, and any dispute fees or return fees. Suppose you just want to create invoices and keep track of your company’s accounts though then this 100% web-based accounting provider might be a good choice.

The only downside to not using a paid solution is that Wave can be a little simpler than most in terms of its features.

If that’s what you want, that’s great, but if you want more invoice customization, a better mobile app for your smartphone, and payroll capabilities, you’re going to want to pick one of the other solutions like FreshBooks.

For free accounting software, you can’t beat Wave accounting. Great for self-employed, freelancers, and small businesses trying to keep business costs low.

Features:

- Invoicing

- Expenses

- Double Entry Accounting

- Payments (for a fee)

- Reporting

- Accounting

- Free accounting App available

5. Xero

Xero are another web-based accounting software that offers an all-in-one solution to your business accounts needs with 24/7 online support.

Xero offers all the core accounting features you’d expect from a top software tool.

You’ll be able to pay bills, see your cash flow, submit returns, keep track of your employees’ expenses, accept payments, and connect your bank directly to Xero. Manage your employee Payroll (paid add-on), take inventory, capture copies of receipts, and send invoices from a single account.

But that’s not all. You’ll be able to create and send quotes to clients, helping streamline your business processes and saving time and money.

With everything all in one place, the Xero accounting system also has in-depth reports and analytics with more advanced analytics in their paid-for Analytics Plus option.

Whether you’re an accountant, bookkeeper, or just trying to grips with your day-to-day accounting needs, Xero is a good option with plans to suit everyone’s needs.

Sign up for a 30-day free trial, get to know the user interface, and see all that’s on offer.

After that, they have reasonable prices plans, but you will need to pay for optional add-ons like Payroll, Expenses Claims, Track Projects, and Analytics Plus.

Features:

- Invoicing

- Quotes

- Bank Transactions

- Cashflow

- Reporting

- Accounting

- 24/7 Support

- Payroll (paid add-on)

- Bookkeeping software

6. Zoho Books

Zoho as a company offers many business-related products, including a Customer Relationship Management platform, secure business email, social media management, and customer service solutions, and a financial platform to help grow your business.

Zoho Books is what we will be focusing on here, which is their accounting software designed to help you manage your business finances and help automate processes via an easy-to-use interface.

With an online solution available via desktop and mobile app, you’ll be able to perform end-to-end accounting, from sending quotes to invoicing to taking payments.

Keeping track of your inventory, keeping track of your payables, and keeping track of projects lets you control everything on time and within budget.

Zoho Books 50+ business reports lets you see overviews of all the different areas in easy-to-view snapshots with the option to filter and narrow down specifics.

They offer not only a 14-day free trial of their services but also a free plan for small businesses with revenue of less than 50,000 USD per year.

Larger businesses with higher turnover have 3 options with added features making this one of the most feature-rich small business accounting software you’ll use.

Features:

- Quoting

- Payments

- Invoicing

- In-depth Accounts Reporting

- Project Accounting

- Inventory Tracking & Management

- Payables

- Recurring Payments

What is the best accounting software for small business?

Accounting software comes in all different shapes and sizes. Depending on what features you need and how large your business is will determine which is the best accounting software for your small business.

We advise you to take some time to find out the features you need first. Once you have that, find the right online accounting platform with those features and sign up for their free trial.

It’s a great way to test every aspect that they have to make sure it’ll save you time and money rather than cost you more to learn how it all works.

In terms of free accounting software for small businesses and freelancers, Wave offers a good option here, but for those with more advanced needs than the basics, like Payroll features, we recommend you check out Sage or Quickbooks.